Expatriates in Panama now have a definitive answer to questions about legal costs. The country’s Supreme Court of Panama enforces a mandatory minimum fee schedule for all attorneys. This official tariff, established in 2021, standardizes pricing for services from visa applications to property purchases and directly counters perceptions of arbitrary “gringo taxes.”

Supreme Court Agreement No. 609-A created a binding national price floor that lawyers cannot legally undercut. The system aims to protect professional integrity and provide clients with predictable cost expectations. For foreigners navigating key life events in Panama, understanding this schedule is crucial for accurate budgeting and identifying practitioners who operate outside legal boundaries.

“The lawyer is often simply adhering to the law. A lawyer who offers a massive discount is the one you should worry about. They are effectively telling you they are willing to break the law before you’ve even signed the contract,” explained a Panama City attorney who requested anonymity due to professional rules. [Translated from Spanish]

This framework demystifies the true cost of legal representation. It replaces speculation with a transparent, court-mandated structure.

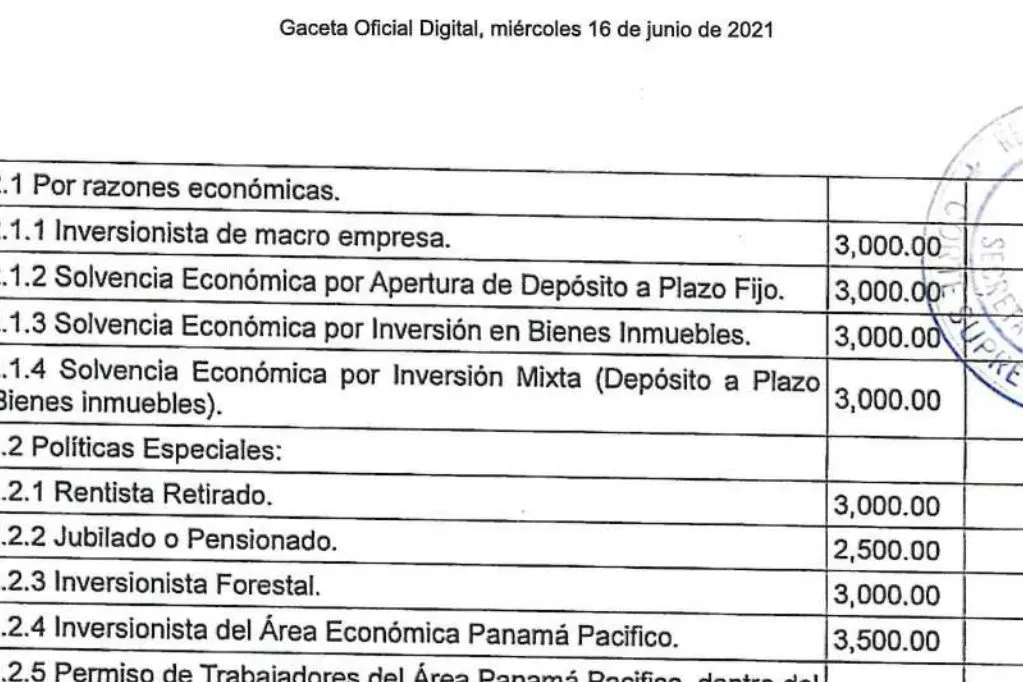

Fixed Minimum Costs for Residency Visa Applications

Immigration procedures form the first major legal expense for most newcomers. The 2021 tariff sets non-negotiable minimums. These figures cover only the attorney’s professional fee, not the separate government costs like application fees or mandatory bank deposits.

For the popular Pensionado Visa and the Friendly Nations residency program, the minimum legal fee is $2,500. Applicants for the Qualified Investor Visa, often linked to real estate investment, face a $3,000 minimum. Naturalization services start at $3,500. Adding dependents costs an extra $1,500 per person in legal fees alone.

Regulated Fees for Property Purchases and Due Diligence

Legal fees for real estate transactions operate on a progressive scale tied to the property’s value. This provides cost predictability for buyers and sellers during a closing. For properties valued between $30,001 and $2,000,000, the minimum fee for drafting the purchase-sale agreement is one percent of the transaction value.

Conducting a separate title study (real estate due diligence) incurs additional costs. That fee starts at a minimum of $1,000 for properties under $250,000. For luxury properties exceeding $1,000,000, the rate drops to 0.65% with a firm minimum of $1,875. These regulated rates aim to prevent surprise overcharges and ensure attorneys are compensated for the liability they assume when certifying property titles.

“When an expat receives a quote that seems high, they aren’t necessarily being ‘gringo-taxed.’ The reality is far more structured,” the Panama City attorney added. [Translated from Spanish]

Why Legal Quotes Can Vary Above the Minimum

The court’s tariff establishes a legal floor, not a ceiling. Law firms frequently charge above the minimum based on several permissible factors. An attorney’s specific experience, the unique complexity of a case, and the economic importance of the matter all justify higher fees. A senior partner will logically command more than a newly licensed attorney for a complex real estate transaction.

The real danger for clients lies at the low end of the spectrum. A quote dramatically below the official minimum violates the law. Choosing a lawyer who openly disregards the fee schedule poses a serious risk. It suggests a willingness to cut corners that could extend to handling a client’s sensitive immigration or property paperwork.

Enforcement and Risks of Non-Compliance

Enforcement of the tariff is taken seriously within Panama’s legal community. The Tribunal of Honor and Discipline handles complaints about fee violations. Professional ethics codes authorize severe penalties for non-compliance. Sanctions range from formal reprimands to the temporary or permanent suspension of a lawyer’s license to practice.

For an expatriate client, their attorney’s suspension can create immediate problems. Legal processes like a residency application or property transfer can freeze indefinitely. This regulatory environment makes vetting an attorney’s reputation essential before engagement. Clients should confirm their lawyer is in good standing with the national bar association.

Standardized Pricing for Asset Protection Services

Establishing Panamanian corporations or private foundations for wealth management follows the same regulated principles. Every locally registered entity must retain a licensed attorney as its resident agent. The law sets the minimum annual fee for this mandatory service at $250. Drafting a basic power of attorney starts at $200.

More complex estate planning, including wills, typically uses hourly billing. The mandated minimum hourly rate for all legal services in Panama is $150. These fixed costs provide a reliable baseline for expatriates engaging in financial and legacy planning. The structured system ultimately offers transparency, allowing savvy individuals to budget accurately and engage legal counsel with confidence.